The Activist Investor Blog

Small Cap Activist Investing

With all the hot activist investing news these days about Pepsi, Allergan, Sotheby’s, Darden, and the rest, it’s easy to overlook that a lot of activist projects involve smaller companies.

We ran some figures on this subject. Based on our cursory analysis, activism at small cap companies outperforms that at larger companies. We think it has to do with how much (or little) a small cap company knows about activism and corp gov.

Activist Investing Alpha

Investors and others know well how activist investing delivers superior returns. Scholarly research and activist manager returns show that activist investor performance exceeds benchmarks by a comfortable margin.

Investors have also known that small cap equities outperform large caps over time. So, the combination of activist strategy with small cap returns should deliver material gains to investors. And, the available data also suggests that small cap activism outperforms large cap.

The invaluable FactSet SharkRepellent database has about 1,100 relevant activist situations since January 1, 2006. SharkRepellent deems these 1,100 situations “closed”, and also establishes a start date for each situation based on their review of the facts, including the filing of a Form 13D, a news release, or other information. SharkRepellent also identifies the kind of activism each situation involves, including proxy fights, shareholder proposals, and say-on-pay votes. (As we said, it’s a terrific resource.) Thus, the sample does not include companies with a Form 13D filing but no further information.

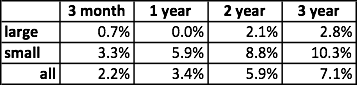

These 1,100 situations delivered superior returns, a finding consistent with other research on activist investing. The complete sample has an average 3-month excess return of 2.2%, relative to an industry sector benchmark for each company in the sample, measured from the start date that SharkRepellent assigns to each situation. Returns just improve over time, with a one-year cumulative excess return of 3.4%, 5.9% over two years, and 7.1% over three years.

Small Cap Activist Investing Alpha

We divide the sample into large and small companies. Conveniently, at a market cap of $500 million, a typical (perhaps low) demarcation for small cap companies, the sample segments into two almost-equal halves. In particular, 532 activist situations involve companies with a market cap of over $500 million at the start of the activist project, and 556 involve companies with a market cap of $500 million or less.

This perspective generates some remarkable results. The large cap companies generate measurable excess returns, but it takes a couple of years for these returns to reach 200 basis points above a benchmark.

In contrast, small cap companies generate more immediate, and more significant, cumulative returns. After three months, these companies returned an average of 3.3% above their benchmark. This increases significantly over time, to 5.9% after one year, 8.8% after two years, and 10.3% after three years.

Why Small Cap, Then?

Investors know well the pros and cons of small cap equities. These companies can deliver huge gains, but with greater volatility than large cap companies.

Small cap companies tend to have poor disclosure practices relative to large cap, so an activist investor has to dig much harder. And, low trading volumes make accumulating a meaningful position tricky.

Yet, the small capitalization means a patient investor can build a significant stake within the boundaries of a fund’s allocation rules and policies. A PM can accumulate 5-10% of a $200 million market cap company, but could buy at best a small fraction of a percent of a large cap. And, 5-10% is plenty for an activist project at most any portfolio company.

Finally, in our experience, small cap companies know relatively less about activist investing, or even corp gov generally. They stack the BoD with friends, and have unsophisticated exec comp programs and outdated bylaws. Their smaller BoDs make it easier to win a majority, or at least a couple of influential seats.

They also lack an IR department, and sometimes even a sense of how to relate well to shareholders. They are at best vaguely familiar with the state corporate law and SEC regulations that govern their relations with shareholders. They don’t use the defenses against investors that large companies have mastered, such as poison pills. They don’t have the budgets for, or even awareness of, high-priced attorneys and PR firms.

All this means that a resourceful investor can know as much or more as the management of a portfolio company about how to influence that company:

-

❖You understand the interaction of company bylaws, state corporate law, and SEC regulations, and how they permit or restrict investor rights.

-

❖You engage other investors probably before management has done so, and probably more effectively than management will.

-

❖You know more about state-of-the-art corp gov, exec comp, and activist strategies and tactics, such as for special meetings, consent solicitation, and exempt solicitation.

Overall, an activist project is just easier at small cap companies, and more likely to succeed, than at large caps. We think this helps explain the superior returns we observe for small cap activist situations.

Tuesday, August 5, 2014