The Activist Investor Blog

How Use of Share Buyback Proceeds Refutes Short-Termism Claims

We investors really love share repurchases. We also resent accusations of short-term thinking. It upsets us that our love of share repurchases has led to those accusations.

We pulled together some data that refutes these accusations. Other good analyses do so by appealing to the long holding period of our investments, or by analyzing the positive long-term impact of activist investing on portfolio companies.

We wondered, how do investors use the proceeds of share repurchases? Clearly, we don’t frame the checks uncashed, incinerate the bills, or put the money in a mattress.

At the same time we love share repurchases, we adore the latest technology investments. And, not just the current app or cloud storage company. We shovel money with reckless abandon at biotech, media, and services start-ups, driving valuations to insane levels.

A cursory look at recent trends shows that on balance, shareholders shift the proceeds of US share repurchases to all manner of speculative investments.

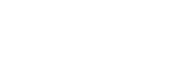

In the past three years, share repurchases increased nicely, from a little under $400 billion in 2012 to over $550 billion in 2014. At the same time, funding of alternative investments exceeded share repurchases in each of those years. It grew from over $550 billion in 2012 to almost $600 billion in 2013, and jumped to over $650 billion in 2014. These alternative investments comprise much of the investment that critics accuse activist investors of limiting.

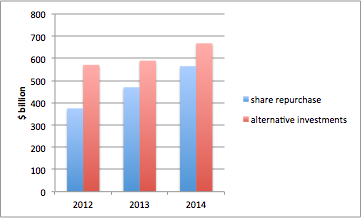

This alternative investment consists of three types: private equity, IPOs, and venture capital. Private equity dominates this investment, and remains largely stable. Venture funding increased during the period, and IPOs increased even more.

We don’t know, exactly, what kinds of companies and technologies make up the alternative investment space. Obviously, we see venture capital and IPOs in new technologies. Further, we doubt that PE sponsors fund mostly mature, slow-growing companies with few R&D opportunities.

In this sense, we investors reallocate capital away from established corporations with aging technologies. We direct it to better uses, which these days come to us in IPOs, venture capital, and private equity deals.

We really do like long-term investment in speculative R&D. We just don’t like big, slow corporations with entrenched leadership to do the investing.

Tuesday, June 23, 2015