Equity Turnaround Services

Turnaround Services

Turning around a failing equity investment follows a logical process, as do our services to assist investors with such a turnaround.

The first and possibly most important step is to have the will to do it. Too many investors have grown accustomed to passive investing, in which you only hold or sell an underperforming firm. US securities law, and indeed the principles of public equity ownership, gives you an important say in how executives manage the capital that you entrust to them. Once investors understand that management works for them and no one else, they confidently can become active in the direction and operation of a firm using the strategies and tactics explained below.

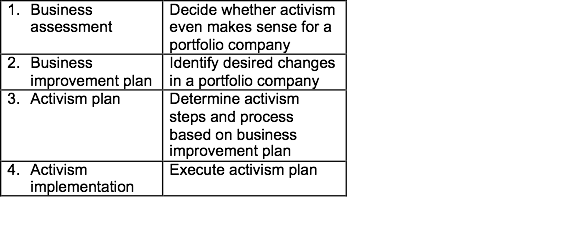

Our services generally follow these phases or steps:

We customarily work with securities counsel, investment bankers, proxy solicitors, public relations firm, and others, as needed and appropriate, to constitute a turnaround team.

Professional fees typically entail a fixed fee for each of the first three phases, and a monthly retainer for the fourth phase.

We will also work pursuant to a contingent or success-fee arrangement. Please contact us to discuss your particular equity investment and how we can advise on a turnaround using activist strategies.

Copyright 2008-2014 Michael R. Levin - all rights reserved.